A standard lot is equivalent to , units of the base currency in your forex trade. It is the most common lot used by institutional investors and the default size that you will see on many trading platforms. In a standard lot, this means that a single-pip movement in either direction corresponds with a $10 change The standardsize for a lot is , units of currency, and now, there are also mini, micro, and nanolot sizes that are 10,, 1,, and units. Some brokers show quantity in “lots”, while other brokers show the actual currency units It is one of the prerequisites to get familiar with for Forex starters. Standard Lots This is the standard size of one Lot which is , units. Units referred to the base currency being traded. When someone trades EUR/USD, the base currency is the EUR and therefore, 1 Lot or , units worth , EURs. Mini Lots

Lot Size Calculator

For a foreign exchange forex trader, the trade size or position size decides the profit he makes more than the exit and entry points while day trading forex. Even if the trader has the best forex trading strategy, he takes too little risk or too much risk if the trade size is very small or huge. Traders should avoid taking too much risk since they will lose all their money. Some tips on how the trader should Determine Position Size are provided.

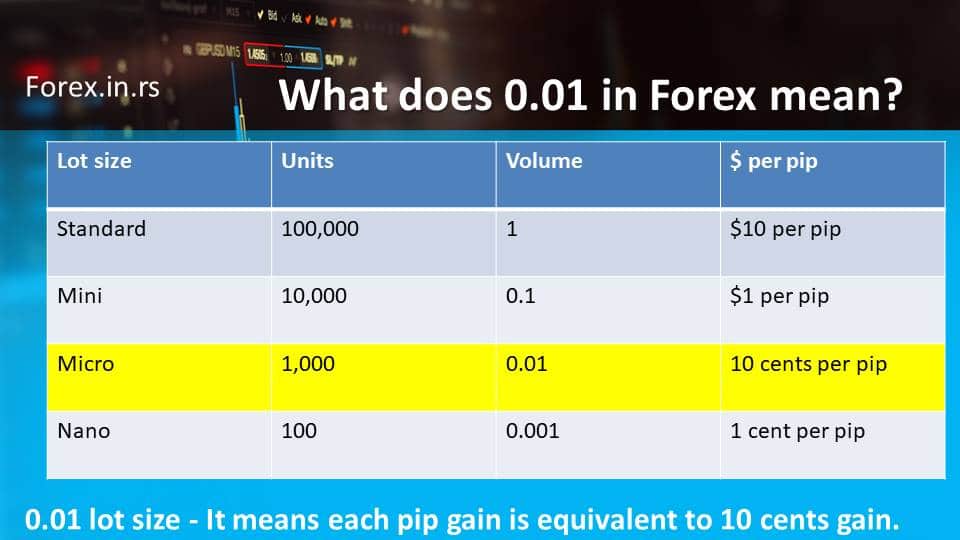

What is a forex units to lots in forex? Lot in forex represents the measure of position size of each trade. A micro-lot consists of units of currency, a mini-lot The risk of the forex trader can be divided into account risk and trade risk. All these factors are considered to determine the right position size, irrespective of the market conditions, forex units to lots, trading strategy, or the setup.

The standard forex size lot isunits of currency. Usually, brokers represent forex lot size with currency units. For example, 5 lots are currency units. In this video, we will see lot size forex trading example:. How to calculate lot size in forex? Forex lot size can be calculated using input values such as account balance, risk percentage, forex units to lots, and stop loss.

In the first step, the trader needs to define a risk percentage for trade and then define stop loss and a dollar per pip. A trader needs to determine lot size number of units for currency pair in the last step. To calculate risk percentage for trade using account balance, traders can define risk in dollars per position trade.

While the other trading variables may change depending on the trade, most traders will keep the percentage they risk on the trade constantly, forex units to lots, though the amount risked for the trade may be forex units to lots if it exceeds the 1 percent limit, forex units to lots.

To calculate forex size position based on dollars per pip, traders need to divide the risk per dollar by several pips. A pip is an abbreviation for price interest point or the percentage in point, which is the lowest unit for which the currency price will forex units to lots. When currency pairs are considered, the pip is 0. However, if the currency pair includes the Japanese yen, the pip is one percentage point or 0.

Some brokers show prices with an additional decimal place, and this fifth decimal place is called a pipette. In the case of the Japanese yen, the third place is the pipette. m The Pip risk for each trade is calculated as the difference between the point where the stop-loss order is placed and the entry point.

A forex units to lots will close a trade when it is losing a specified amount. The stop-loss level also depends on the pip risk for a specific trade. The volatility and strategy are some factors that determine pip risk. Though traders would like to ensure that their stop loss is as close to the entry point as possible, keeping it too close may end the trade before the expected forex rate movement occurs.

How to calculate stop loss in pips? To calculate stop loss in pips and convert in dollars, traders need in the first step to find the difference absolute value between the entry price level and stop-loss price level. In the forex units to lots step, traders need to multiply Pips at risk, Pip value, and position size to calculate risk in dollars.

For example, if a trader buys EURUSD at 1. In a currency pair that is being traded, the second currency is called the quote currency. If the trading account is funded with the quote currency, the pip values for various lot sizes are fixed at 0. Usually, forex units to lots, the forex trading account is funded in US dollars. So if the quote currency is not the dollar, the pip value will be multiplied by the exchange rate for the quote currency against the US dollar.

How to find a lot of size in trading? In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number of units. Step 1: Calculate risk in dollars.

Step 3: Calculate the number of units USD 0. Technically, it is 2 micro lots because most brokers do not allow trading less than micro-lots. In MT4, calculate lot size using a lot size calculator. If you know your risk, you can calculate lot size using the calculator below:.

The lot size forex calculator is represented below. Privacy Policy. Home Choose a broker Best Forex Brokers Learn trading Affiliate Contact About us. Home » Education » Finance education » How to Calculate Lot Size in Forex? How to Determine Forex Position Size For a foreign exchange forex trader, the trade size or position size decides the profit he forex units to lots more than the exit and entry points while day trading forex.

Lot size in forex trading What is lot size in currency trading? Author Recent Posts, forex units to lots. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all.

What is Leverage Meaning? How to Calculate Pips in MT4? How to Fix When MT4 Stuck on Waiting for Update? Related posts: Forex Profit Calculator Forex Spread Cost Calculator Lot Size Calculator How to Calculate Risk Reward Ratio in Forex Risk Reward Calculator Calculate Crude Oil Lot Size — How to Read Oil Pips?

USDJPY Pip Count — How to Calculate JPY Lot Size? How to Calculate Equity Multiplier? How to Calculate Forex Volume? How to Calculate Gold Pips? Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world. Diversify your savings with a gold IRA. VISIT GOLD IRA COMPANY. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates What is PAMM forex units to lots Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours Which Forex Broker Accept Paypal? Main navigation: Home About us Forex brokers reviews Investment Education Privacy Policy Risk Disclaimer Contact us. Forex social network Forex units to lots Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language.

Lot Sizes EXPLAINED! (Forex Trading)

, time: 7:43How to Calculate Lot Size in Forex? - Lot size calculator - Forex Education

Forex Lot Size Calculator calculates the required position size depending on your currency pair, risk level (percentage or money), and pips stop loss. Calculate Standard, Mini, and Micro lot size. For Example 1,00, units = 1 Lot (Standard) 33, units = Lot (Standard) 1, units = Lot (Standard) Risk Management Tip 1/4/ · But in Forex, there are some preset “packages” of lot size units. These are the lot sizes that are available in Forex: Standard Lot: , currency units (lot size of 1 in MetaTrader) Mini Lot: 10, currency units (lot size of in MetaTrader) Micro Lot: 1, currency units (lot size of in MetaTrader) A standard lot in forex is equal to , currency units. It’s the standard unit size for traders, whether they’re independent or institutional. Example: If the EURUSD exchange rate was $, one standard lot of the base currency (EUR) would be , units

No comments:

Post a Comment